No longer boosted by COVID-19, Colorado marijuana sales leveled off

[ad_1]

Colorado’s sales figures and budget forecast show that the growth of the marijuana industry has finally stalled after the increase in sales of COVID-19.

Unlike much of the economy, the cannabis industry has benefited greatly from the COVID-19 pandemic, with Colorado dispensaries breaking records to reach nearly $ 2.2 billion in sales last year. Those strong sales continued into 2021, but as the weather warmed and local collection restrictions loosened, dispensaries started to see less action.

After six consecutive years of annual growth during the months of June, July and August, 2021 summer pot sales fell from last year, according to data from the Marijuana Enforcement Division state, and state economists predict a further contraction to come. The most recent quarterly economic forecast from the Governor’s Office of Planning and Budgeting indicates that Colorado’s marijuana tax revenue fell nearly 6% in fiscal year 2021-2022 after “relatively higher collections. weak than expected in July and August â€. Income is expected to increase again – albeit at a slower pace – until 2024.

“There has definitely been a COVID bump; I think it’s pretty clear,†said Truman Bradley, executive director of the Marijuana Industry Group. “It makes perfect sense: all the bars and concert halls were closed. People couldn’t get together, and there just weren’t a lot of things the Coloradians could do.”

Although the report from the governor’s office says more data is needed to draw firm conclusions about the drop, the theory is that home pot consumption declined in Colorado in 2021. Outdoor use by residents and tourists increased over the same period, the report adds. , highlighting the increase in sale rates in mountain towns, but that was not enough to thwart the reduced number of people smoking weed at home in Denver.

As CEO of Slang Worldwide, a marijuana holding company that owns multiple brands in Colorado, Chris Driessen must monitor sales trends to position and market Slang affiliates. According to Driessen, the plateau was anticipated by the majority of the pot industry, but it could be more complicated than coming out again. Driessen has noticed lower-cost products have been purchased in larger quantities since 2020 and believes consumers have become more mindful of their spending in the face of income uncertainty.

“People have become more conscious of their spending, but overall they spend more because they were consuming more,†he says. “But now people are working less from home. We are seeing the end of the moratorium on evictions and unemployment benefits, and people are increasingly mindful of their discretionary spending as they increase their workload. ”

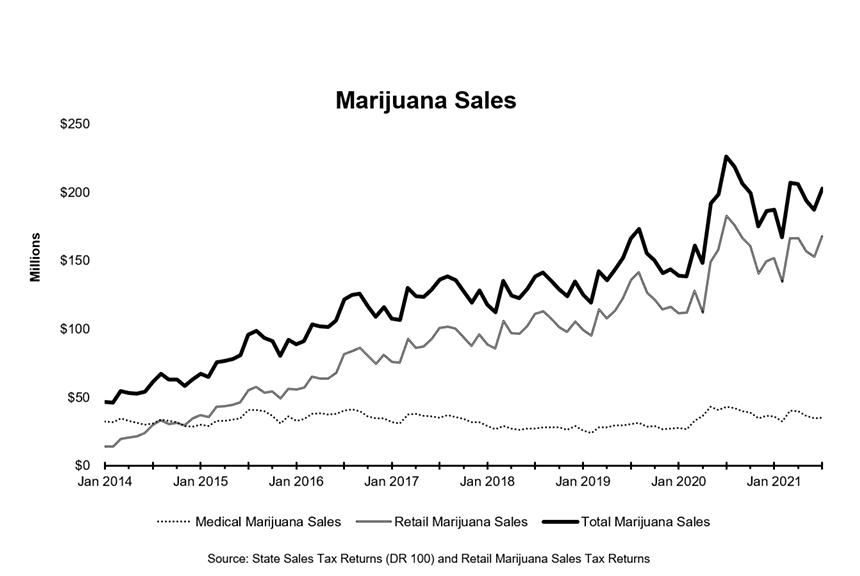

Colorado marijuana sales, 2014 to July 2021.

Colorado Marijuana Law Enforcement Division

Despite the cooling, marijuana business owners still have reason to be optimistic, according to Driessen, who points out that tourism in Colorado, a major driver of dispensary sales, has still not fully returned since the pandemic. . Bradley also sees more long-term potential after a “very strange” year.

“It’s not going to increase forever, but as people move away from other substances like alcohol, cannabis continues to grow in popularity. The population of the state is also increasing and the number of tourists is generally important to Colorado. I don’t see these three trends slowing down, so I’m bullish on cannabis sales, “Bradley predicts.

The marijuana industry is also coming back to earth in the workforce. Fall sees a spike in temporary workers every year to help with outdoor harvests, but business owners are struggling to fill those positions this year, according to Veridian Staffing, a recruiting agency for marijuana companies.

Veridian began noticing a growing need for staff in the Colorado marijuana industry around July, according to CEO Kara Bradford, with a particularly strong need in Denver. This has led to a demand for increased wages among marijuana cutters and harvest workers.

“[Marijuana workers] get into the hotel and service business, where they don’t necessarily get the same hourly rate, but they get a lot of tips. So we’ve asked some of our clients to consider a bonus on top of the hourly wage for employees who do a great job in harvesting and pruning, â€she explains. “We’ve been in an employer market for so long, and now we find ourselves in a situation where people are choosing not to return to work for a number of reasons, and some workers have just moved during COVID. ”

Rural businesses that have a smaller pool of workers in low cost of living areas could be even more affected. Driessen, who oversees Slang’s partnerships across the state, says he is aware of copper Mountain marijuana production facilities that closed in 2021 due to a lack of employees.

The move to higher wages is another sign of the industry’s evolution, but is also leading to lower profit margins, Bradford explains. Although new to Colorado marijuana, it could be a necessary growing pain for business owners.

“We’re watching it happen from state to state. I think Washington and Colorado, and to some extent California and Oregon, are all experiencing this shortage. As more markets come in. line, they go through similar transitions, â€she said.

[ad_2]